Anadarko Ratchets Up Drilling In Colorado Oil Play

Upstream online article, February 21st 2014

“Houston-based Anadarko Petrol-eum is cranking up its operated drilling programme in an emerging play in eastern Colorado centred around the Las Animas Arch, where it could leverage a massive legacy leasehold to patiently unlock the new area.”

View article here – Upstream Online

Recent Information

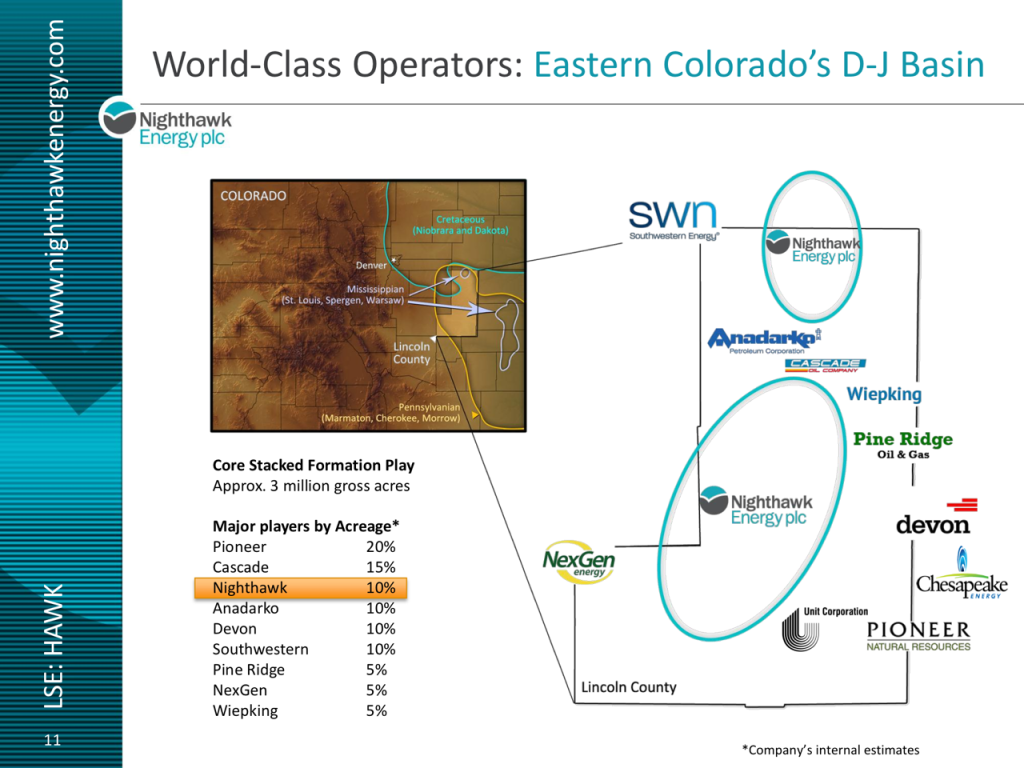

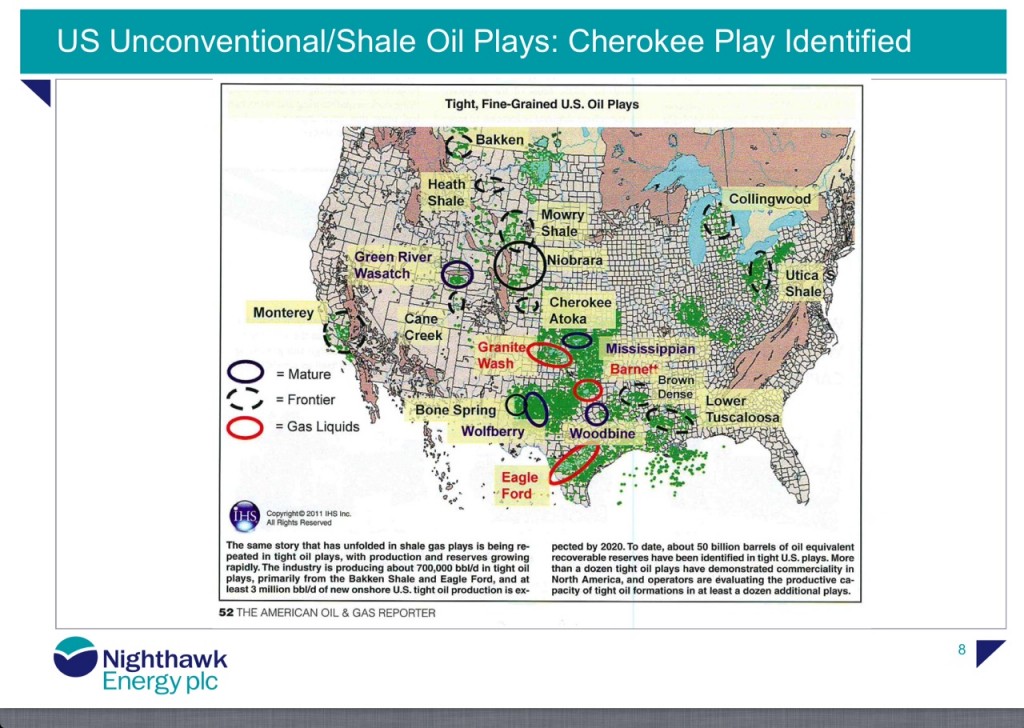

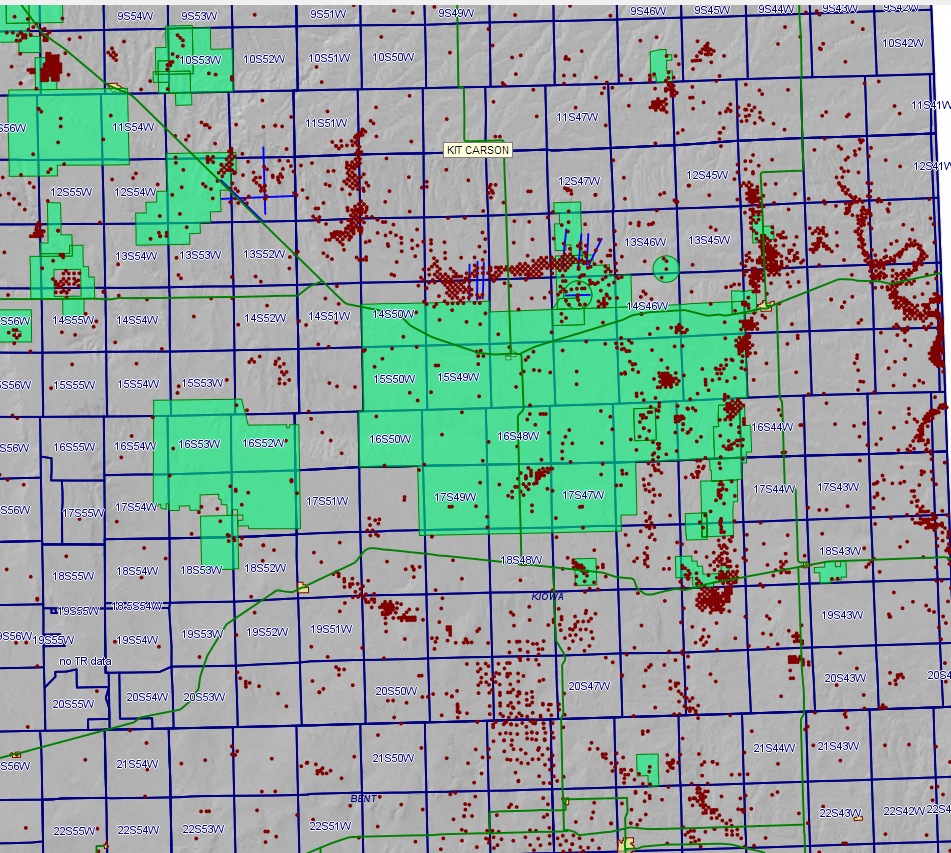

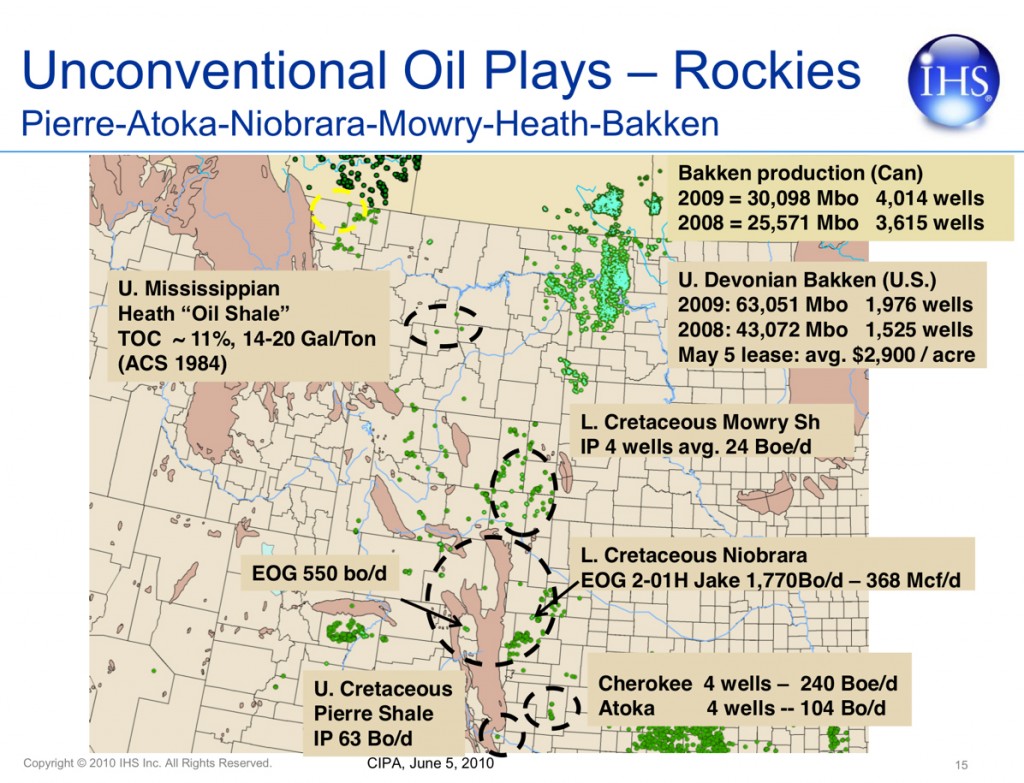

700 sq mile seismic shoot underway around SECORO’s acreage in SECO

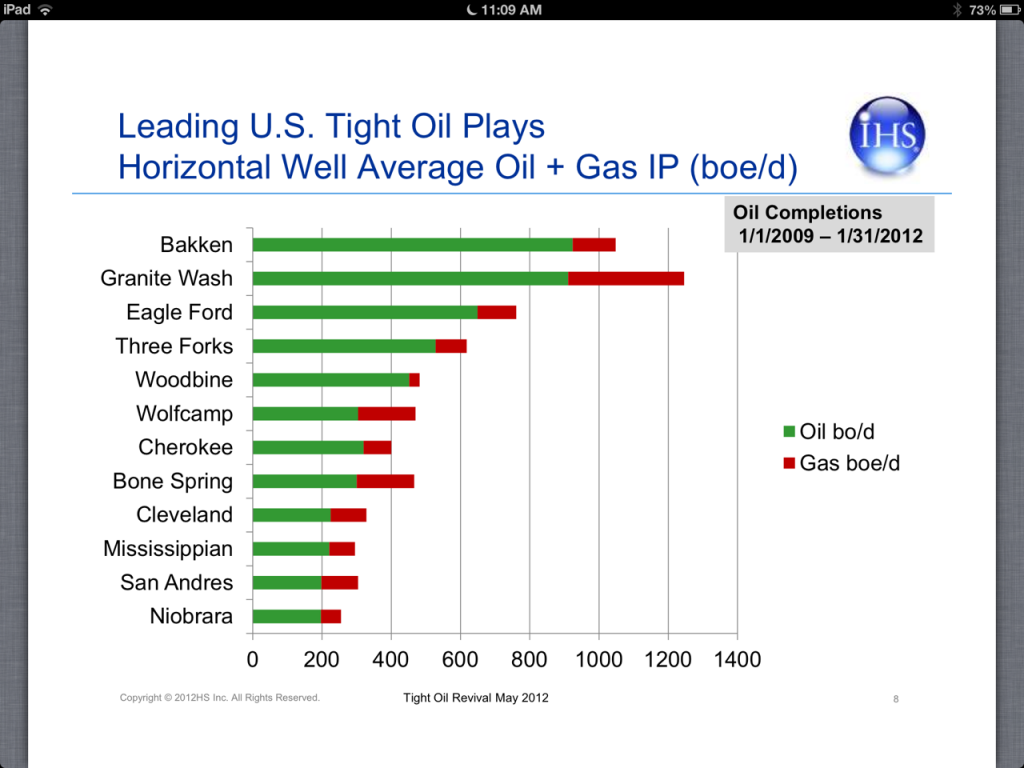

SECO on the map with other large unconventional oil and gas plays in the US

Southeast Colorado Update – 7/8/13

Southeast Colorado Update

Summary of Mineral Lease Activity and Exploration for Southeast Colorado Mineral Owners

July 8, 2013

This is a summary of many news reports from petroleum industry, financial sector and media sources that help to describe what’s going on with petroleum resource development in Southeaster Colorado (SECO) in 2013. We’ve done our best to provide reliable information, but be aware that all of these sources filter their publicity, and may manipulate the content of their releases for marketing reasons or to protect corporate secrecy. Always be on guard about anything that you hear or read, and use due diligence and appropriate caution before making decisions with financial or human consequences. Owners of mineral rights and surface acreage have typically been at a disadvantage because of lack of information about what’s going on in their locality. We hope that this summary helps to bring a little light to your situation.

Mineral Leasing in 2013

Since well before 2011, substantial public and private mineral acreage in southeast Colorado (SECO) was controlled by several major oil companies, and continues to be under long-standing leases. Starting in 2011, a large industry player and several smaller ones saw the potential to use new extraction techniques to reach quality tight oil reserves in the area, and aggressively attempted to aggregate small and large lease holdings in the Las Animas Arch region. Other companies jumped in to reserve leases they intend hold for a few years then flip for a profit. The 2011-12 southeast Colorado mineral leasing frenzy of ebbed in late 2012. In 2011 lease offer bonuses started at around fifty dollars per net mineral acre (nma). In 2012, bonuses ranged from $100 to $300 per nma and royalties were 12-18 percent. Lease periods were 4/4, 3/5 or 5/3 in most cases. Companies with substantial positions in Southeast Colorado are known to be Nighthawk, Pioneer Natural Resources (600,000 acre position), Anadarko (800,000 acre position), Chesapeake Energy, Southwestern, and Devon Energy.

This year, there are only occasional reports of leasing efforts, proceeding quietly and on a small scale. Some very speculative landmen are trying to pick up a few more leases at last year’s prices to flip quickly for five- to eight-fold profit. They see quick money in this kind of move because even in this summer of few bids, the bonuses negotiated in the serious offers to lease are five time higher than the best 2012 prices.

Those prospective lessees who actually plan to drill are determined to get their bits in the ground before the major companies mobilize. They are both small and large companies acting on opportunities in the leases they acquired up through last 2012. Those who are leasing assets in 2013 and plan to drill write their lease offers with shorter periods (3 years, or 3/2), perhaps reflecting their intent to get ahead of their competition. With smaller aspirations and better funding, some of these smaller operators don’t need an eight year lease to act or to sweeten their option to flip the leases to raise quick capital if they find themselves overextended. Royalties are showing at or above 20 percent.

Wells are already being completed and flow tested. Mineral owners report a pattern that Landmen and their corporate clients seem to push extra hard to write new leases just before data on successful new wells hits the press. Each new, productive well raises the value of mineral acreage in the region as a whole.

The timeline of the SECO play appears to be developing similarly to earlier plays in Texas, Ohio, Kansas and the northeast. In those other regions, companies moved fast to acquire rights to mineral acreage while they could still convince owners that their mineral rights were nearly worthless. As each of those plays have proved out with a mounting list of successful wells, the “worthless acreage” argument didn’t work any more, and the price soared for organized, informed mineral owners. In North Dakota, Pennsylvania, Ohio, Texas and other states, the price per nma ranges $3-14,000 per nma in proven plays. As the risk factor is taken out of drilling, and wells provide good production numbers and the price per acre rises. More well data is needed in SECO before we’ll know whether our play will reach these levels. Note that these acquisition prices may realized as one oil company sells their assets to another, or a company makes a large-scale transaction with an organized mineral owner’s association on a proven play. Based on comparable timelines of development in other plays in the Denver-Julesberg Basin, the Bakken formation, the Utica, Eagle Ford and Kansas, the climbing lease prices in 2013 will look like small change as the reports of new wells’ commercial production capacity mount. Leasing activity becomes an arena of large players and big moves where the isolated land owner is just a little guy: hardly noticed and afforded little leverage. One viable and honored strategy is to join an association of mineral owners and negotiate as a block. Good numbers from the new wells in our region are turning the eyes of the exploration and development sector our way, and are sweetening prices in our negotiations substantially over 2012 prices. More new wells and strong well output data needs to come in to command the high prices in SECO that are the norm in Weld County.

For major petroleum companies who are just now turning their attention toward the Las Animas Arch region, getting a large stake in the play is problematic. Acquiring their own position could involve purchasing leased acreage from a competing major player at premium prices.

If you’re approached with an offer to lease your mineral acreage, be sure to have a qualified attorney review the lease before you sign. The leases may appear to be “standard” in format, but they are not. Clauses that are worded in common-sense language may conceal rights for the lessee that could work against your interests, or lock up your land with the lessee with no compensation for you. You should be held harmless from the actions of the lessee. Surface owners’ rights should be protected. If you aren’t already working with a mineral owners’ group, investigate that avenue. Oil companies can work well with a source that allows them to acquire substantial assets efficiently, as has been seen in Pennsylvania and Ohio.

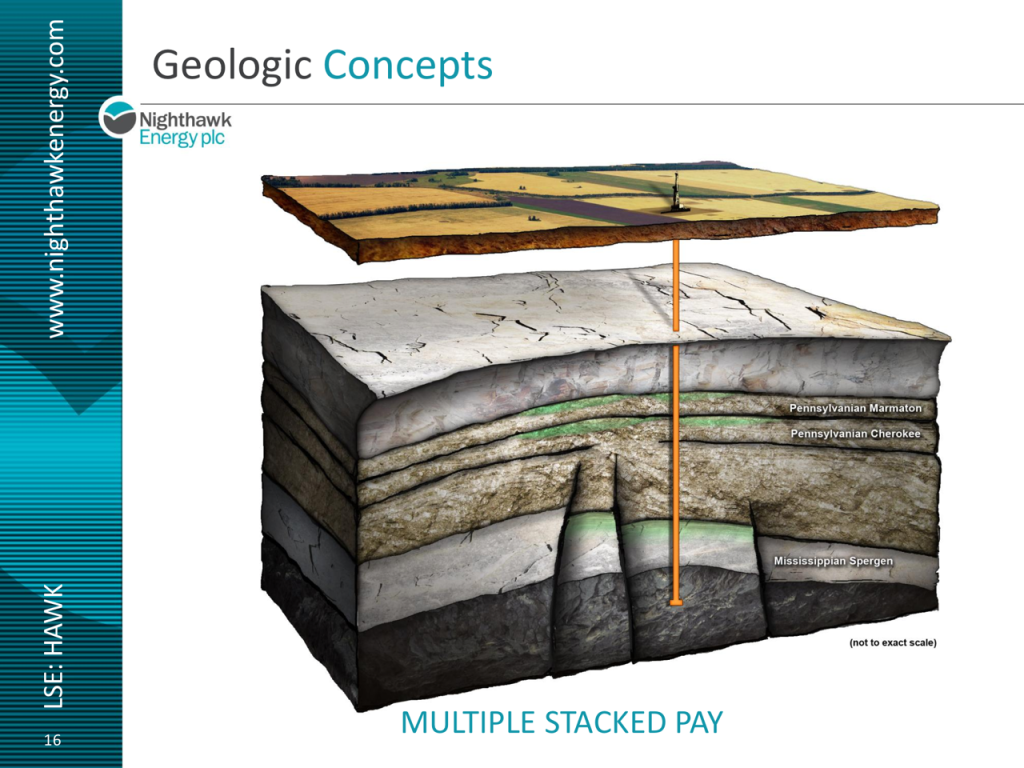

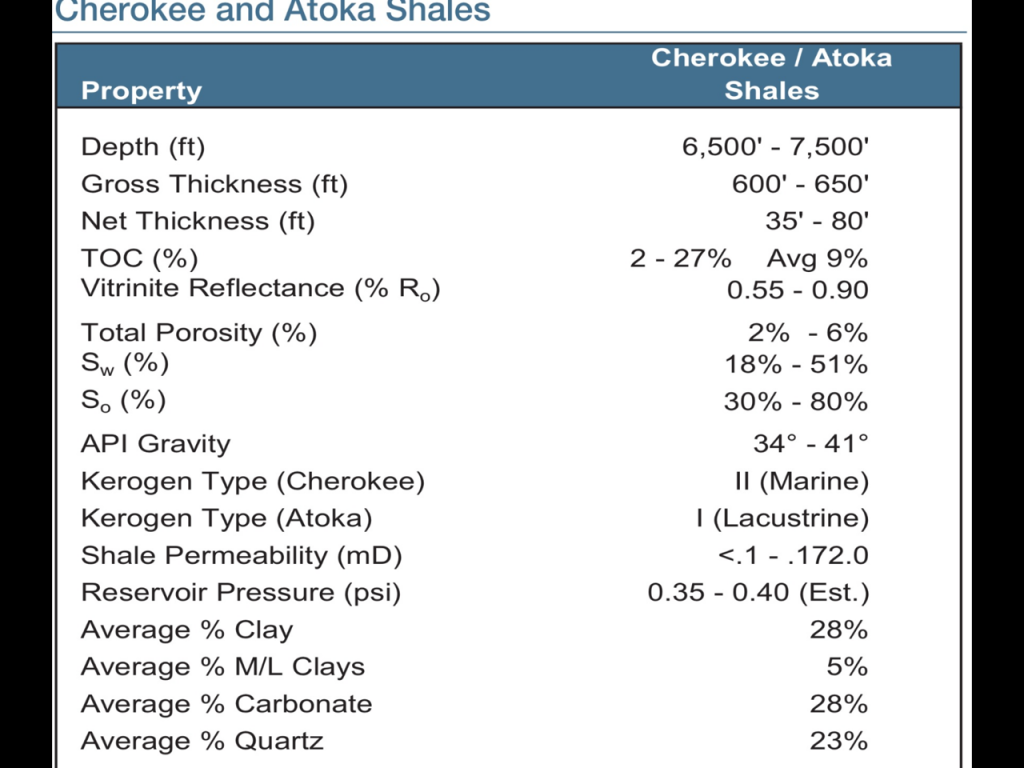

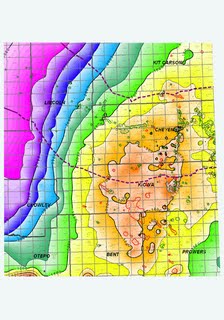

Geology, Technology, and the Potential of Your Mineral Holdings

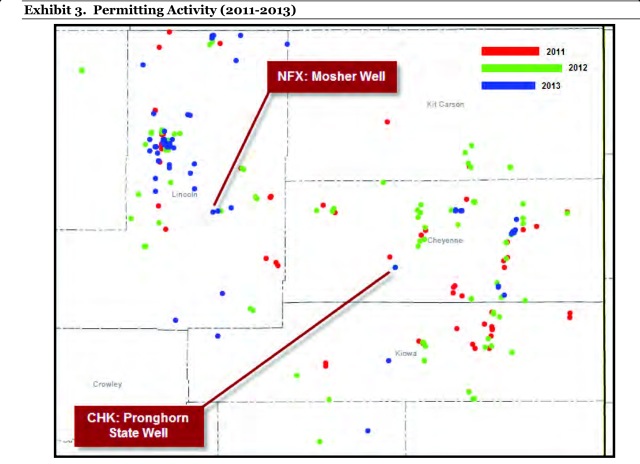

The current calm in leasing new acreage is accompanied by the sound of drilling rigs probing selected target sites, thus far located in Lincoln, Cheyenne and Kiowa counties. The drillers’ targets are several horizons in the 4000 to 6000 foot deep Mississippian and Pennsylvanian strata around the Las Animas Arch. Established USGS data and fresh 2012 3-D seismic data beckon the drillers to the prospect of multiple, deep, stacked carbon-bearing strata, with measurable potential for recoveries. Worker housing is going up in Cheyenne County. Drilling permits are being filed with the State of Colorado Oil and Gas Conservation Commission (COGCC). Access roads are being graded. New drilling in SECO was slow to start because so many crews and rigs were already tied up with contracts in North Dakota, Texas, Kansas, Oklahoma and Ohio.

Security checkpoint at a Kiowa County drilling site

Photo is copyrighted and all rights reserved by the originator. Used with permission.

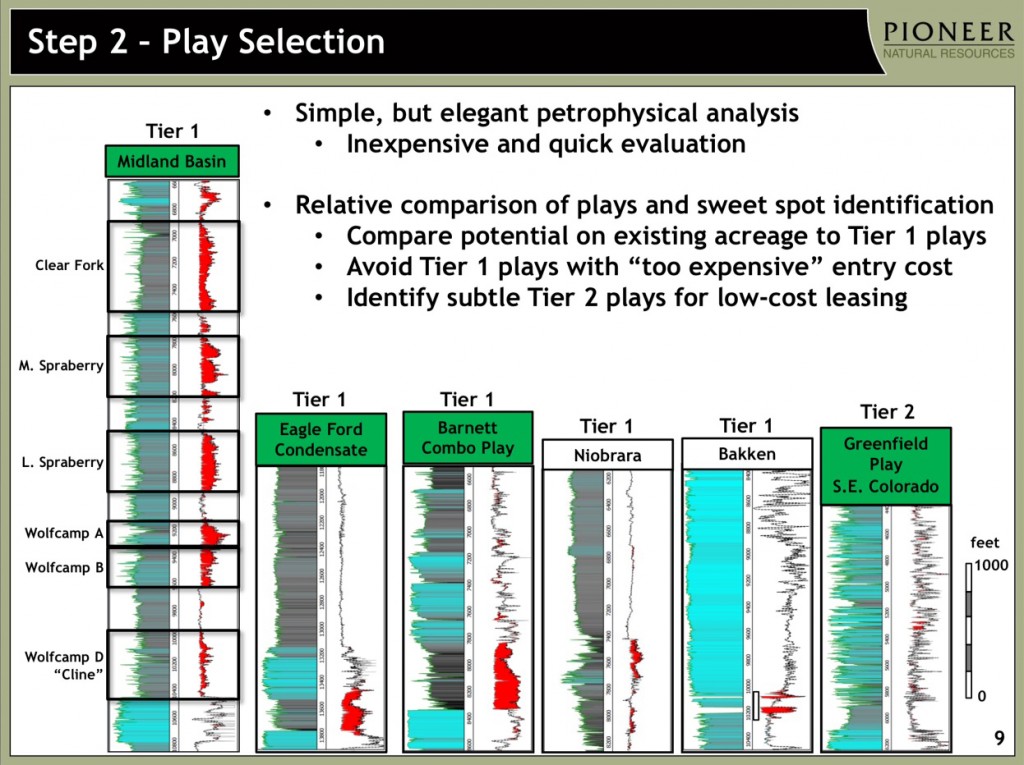

Oil companies are back in southeastern Colorado, bringing with them new technology and improved techniques to recover even more oil and gas from fields that were tapped decades ago, or were previously considered commercially marginal. Better geological understanding helps to predict large-scale opportunities in shale and lime strata ignored when older, “conventional” drilling was the norm. While there’s still a push to locate the “sweet spots”, mineral owners should be aware that the carbon-bearing layers of the Pennsylvanian and Mississippian layers are not pinpoints, but are broadly-laying zones underlying many counties, rather than a perched, localized deposit to be tapped by a lucky wildcat well.

Some areas may produce more than others, some may not be commercially viable, but the old argument that “your parcel isn’t very valuable because it’s a couple of miles away from a productive well” doesn’t necessarily apply to this new push in petroleum resource development, where ten or twenty mile distances to proven well sites still generate a professional “neighborly interest”. To find the richest locales in our play, Pioneer has a 150 section seismic study in progress around the Las Animas Arch, and there’s another seismic study planned that will run across southern Cheyenne county and northern Kiowa county.

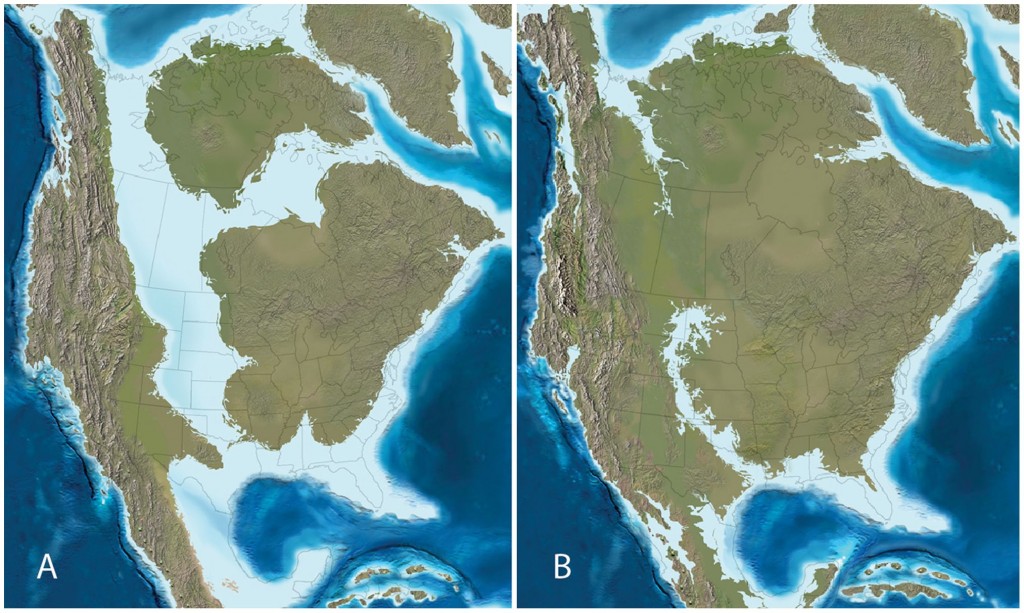

Paleogeographic maps of North America during the (A) late Campanian (∼75 Ma) and (B) late Maastrichtian (∼65 Ma).

Research by Dr. Ron Blakey, Northern Arizona University.

Other credits to: Terry A. Gates, Albert Prieto-Márquez, Lindsay E. Zanno. PLOS ONE. 10.1371/journal.pone.0042135.g001.

Retrieved 21:11, Jul 20, 2013 (GMT).

The petroleum industry success in Kansas has quickly caused the more forward-looking companies to look to Colorado for the western margins of the Late Cretaceous inland seabed that lies a mile below our feet. You can observe a correlation between the maps in the illustration, above, and the the lay of shale, lime and carbonate oil plays in Texas, Oklahoma, Kansas, Colorado, the northern plains states, and the canadian prairie provinces.

Mississippian Closure on Las Animas Arch

Cheyenne County, Kiowa County and the Las Animas Arch are at the center of this map,

which overlays ancient shorelines over county and state map lines

With recent, intensive exploration in Kansas and Texas a pattern has emerged suggesting that over many millennia, oil migrated horizontally to find greater depth when the geology within a basin permitted it to. In the plains states, this can mean a westward migration, as toward Weld County in the Denver-Julesberg basin, and more importantly, the Las Animas Arch, which Wells-Fargo now refers to as “the soul” of the Mississippian play. Aubrey McClendon, former CEO of Chesapeake Energy and now CEO of Associated Energy Partners made this point relative to Chesapeake’s experience in the Utica, in that the Utica appears to have three phases, or windows, similar to the Eagle Ford Shale in South Texas: a dry gas phase on the eastern side of the play, a wet gas phase in the middle, and an oil phase on the western side. The pattern could apply to the Pennsylvanian and Mississippian plays that stretch from Kansas into eastern Colorado. Watch as the results come in to learn for sure.

New oil well borings are configured for both vertical and horizontal components. In some cases, only the exploratory vertical drilling is done, and the horizontal drilling deferred until the vertical drilling data is analyzed. Sometimes, there’s a benefit to the oil companies to refrain from completing the laterals, and so, avoid publicizing the ultimate productivity of a new well.

Instead of peppering an entire section with wells, horizontal drilling allows an oil company to drill multiple wells in several horizontal directions and even to different horizons from a single pad. In the North Dakota Bakken and Texas Permian Basin plays, such a pad may have half a dozen wells, perhaps more. There’s less disruption of the landscape and lower costs for the drilling operation. Also, it’s easier to manage transportation of oil production from a focused location. To make this technique even more effective, the newest well rigs are fitted with hydraulic bases that allow the well operator to draw the bit out of the ground and inch the drilling rig to the next location on the drilling pad without dismantling and reassembling the drilling rig. It’s technology that’s been built into big mining equipment for years, and it’s a smart application to the oil industry.

In past years, geologist and analysts have commented on the negative impact of excess water production experienced in wells in SECO. “The Mississippian is different from other major shale plays like the Bakken and the Eagle Ford in that it’s not really shale; it’s a carbonate formation. This forces oil and gas companies to think differently about how to best develop the play, seen most readily in how these companies handle water . . . One of the biggest problems producers encounter when developing shale resources is water. However, when it comes to the Mississippian, it’s not the lack of water that’s the problem. In fact, the average Mississippian well only takes about 2.2 million gallons of water to frack, which is less than half the amount needed for an Eagle Ford well. The problem is that that there is too much water which causes producers another set of problems” (Motley Fool, Matt DiLallo, June 28, 2013). That assumption is not holding up in the face of experience out of the field. Improved technology and experience-based know-how have developed “work-arounds” to the water issue. Actual well results in Southeastern Colorado now report low water production at many sites. Some of this success may be the result of lessons learned, such as setting the well target deeper than the overall play, in order to control fracturing that would otherwise open water-bearing layers.

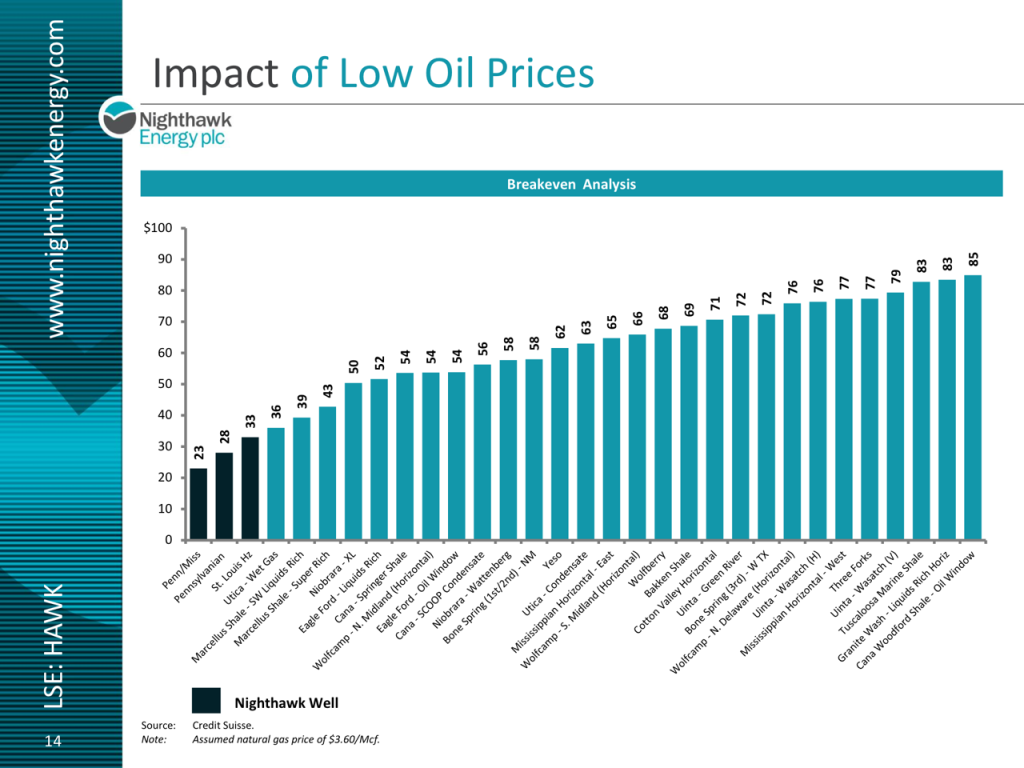

At the same time, costs for the horizontal well drilling phase have declined to the $1 million range per well (a fourth of the $5.4 million cost estimated in 2011) as companies employ the technology and experience gained in the Permian Basin, the Bakken play, Kansas Mississippian Lime, and others. Drillers are finding that wells in SECO are less expensive, just as they’ve been in western Kansas.

Wells Fargo Analysts have projected the estimated ultimate recovery (EUR) of Las Animas region wells to be 120-130 million barrels each.

Drilling and Production Activity

Entrance to Chesapeake’s Nomac operation at the Weimer-State 16-19-47 site

Photo is copyrighted and all rights reserved by the originator. Used with permission.

In Kiowa and Bent Counties, drilling is just getting started. The Weimer well in Kiowa was being turned horizontal and moving toward completion. The rig in use is Chesapeake’s best technology: a $40 million dollar Nomac “Peakerig”. This same rig is scheduled to be moved to the Bent County “Brown” well site this month after it completes the lateral for the Weimer. The #1H Weimer-State 16-19-47, is being drilled south across the section to 9,070 ft. in the Spergen stratum. The well is 10 miles from the nearest existing Mississippian wells in the Wild Sage Brush Field and the Brandon Field. The industry is watching for the results of the Weimer project.

Nighthawk Energy’s Steamboat-Hanson 8-10 well is located in Lincoln County, a reach of the Denver-Julesberg Basin. The announcement of the commercial success of Steamboat-Hanson 8-10 was an industry eye-opener in the first quarter of 2013. Nighthawk now reports that commercial production will begin at its Silverton 16-10 at the Arikaree Creek oil field starting in July 2013. The Silverton 16-10 will draw from a 22-foot pay zone in the Mississippian Spergen formation. In a clear confirmation of its multi-zone strategy, Nighthawk recognized that en route to its goal in the Spergen strata, it had confirmed other oil and gas to recover in the shallower Cherokee formation. Nighthawk’s Snowbird 9-15 will draw from a 24’ thick stratum in the Spergen formation. Nighthawk’s Big Sky 4-11 well began producing over 400 barrels per day with no water production in late May of 2013.

Twenty-two Cheyenne County well permits are on file at COGCC. Private developers have kept news of their well results close to their chests. Chama’s well near Kit Carson, on the other hand, was a publicly-announced success. Per the Denver Business Journal, Rocky Mountain Oil Journal, and HIS, a horizontal well, the Pronghorn State #16-15-48-1H, owned by Chama Oil & Minerals LLC of Midland, Texas, “has reportedly flow tested at up to 2,000 bopd” (barrels of oil per day).” If the Steamboat-Hanson 8-10 was an “eye-opener”, the Chama Pronghorn was a “jaw-dropper”. This was a bigger flow than the “Jake” well that started the rush into the Denver-Julesberg Basin. Chama’s Pronghorn 16-15-48-1H well draws from the same Mississippian formation that’s so productive in southern Kansas, but it’s located near Kit Carson, Colorado, 40 miles west of the Colorado-Kansas line.

The Chama Pronghorn State 15-15-48-1H targets the Pennsylvanian Keyes interval and Mississippian Salem and St Louis Limestone intervals at a maximum depth of 6200 feet.

IHS Inc. reports that Chama is involved in a horizontal Spergen wildcat in Cheyenne County at #1H Kern-State 36-16-46 and is in the permitting process of to drill a horizontal Mississippian wildcat in Kiowa County, Colo.

Be Informed

Be a regular visitor of the COGCC website to check for well permits and results. Stay in the loop with industry publications and websites like the Oil and Gas Financial Journal, the Rocky Mountain Oil Journal, Denver Busines Journal, Oil and Gas Investor, American Oil and Gas Reporter, Wells Fargo news releases and analysis, Nighthawk Energy news releases, Chesapeake Energy news releases, Devon Energy news releases, Motley Fool, and IHS, to name a few. Draw your own conclusions based on the best information you can obtain. We can’t predict whether SECO will produce oil like Weld County or what lease prices will bring in a year. At this point, we can see that there’s a lot of resolve in several oil companies to make southeastern Colorado another pay zone for the industry.

SECORO is a communication network for mineral resource owners of southeastern Colorado. Currently, SECORO communicates with the owners of over 116,000 net mineral acres in Cheyenne, Kit Carson, Kiowa, Bent and Prowers counties of Colorado. The SECORO website is www.secoro.org

These notes are compiled from public, news and industry sources as a partial update to mineral owners covering a variety of aspects of petroleum industry action in southeast Colorado (SECO). Information contained herein is drawn from a variety of published sources and from observations of SECORO participants in the area. In spite of our best intention and effort to relate good and reliable information, the effect of corporate secrecy and calculated filtering of information released by oil companies may cause the content of this report to be incomplete, and possibly contain inaccuracies that we do not knowingly endorse. Please exercise due diligence to verify the reliability of the content of this report before making decisions with financial or human implications.

SECORO provides no legal advice, actionable advice or direction as to land or mineral owners’ decisions regarding management of their mineral interests.

Copyright 2013. All rights reserved. No part of this page may be redistributed, republished, or linked from other websites.

Published Primary and Secondary Sources:

Rocky Mountain Oil Journal

Wells Fargo

Nighthawk Energy

Denver Business Journal

Motley Fool

IHS

Oil and Gas Investor

Rocky Mountain Oil Journal

American Oil and Gas Reporter

Special thanks to our friends, relatives and neighbors in southeast Colorado!

Nighthawk July 12, 2013 Production Report Press Release

Nighthawk July 12, 2013 Production Report Press Release

12 July 2013

NIGHTHAWK ENERGY PLC

(“Nighthawk” or “the Company”)

Production Update

June average oil production exceeds 1,000 barrels per day

Nighthawk, the US focused oil development and production company (AIM: HAWK and OTCQX: NHEGY), announces an update on production at its 100% controlled and operated Smoky Hill and Jolly Ranch projects in the Denver-Julesburg Basin, Colorado.

Highlights

· Average gross oil production in June 2013 of 1,029 barrels per day (“bbls/day”), a record monthly production level for the projects

· Average gross oil production in second quarter 2013 of 631 bbls/day, a 100% uplift on the first quarter 2013

· Silverton 16-10 well commenced production in early July 2013

· Four wells now in production on Arikaree Creek oil-field

· Testing currently underway on the Snowbird 9-15 well on the Arikaree Creek field

· Total production is currently running at over 1,400 bbls/day

Production

Average gross production levels have continued to increase month-on-month driven by the successful drilling program on the Arikaree Creek oil-field. The Arikaree Creek discovery well, Steamboat Hansen 8-10, has now been in production for over seven months with a steadily increasing production rate over that period and no water production.

The Big Sky 4-11 well commenced production in late May 2013 and was followed by the Taos 1-10 well in mid-June 2013. Since coming on-stream the production rates at both these wells have held steady at around 400 bbls/day and 500 bbls/day respectively, with no water production. With these three wells on-line total production from Arikaree Creek for the second half of June was approximately 1,200 bbls/day.

The fourth well in the Arikaree Creek drilling program, the Silverton 16-10 well has commenced production. The well is still settling down and initial production rates are around 200 bbls/day . Testing is currently underway on the fifth well on Arikaree Creek, the Snowbird 9-15.

Total production from all producing wells is currently running at over 1,400 bbls/day

Gross Oil Production 2013

| Month | Total Production

(Barrels of Oil) |

Average Production

(bbls/day) |

| Quarter 1 2013 | ||

| Jan | 8,677 | 280 |

| Feb | 7,950 | 284 |

| March | 11,548 | 372 |

| Q1 Total | 28,175 | 313 |

| Quarter 2 2013 | ||

| April | 12,067 | 402 |

| May | 14,489 | 468 |

| June | 30,869 | 1,029 |

| Q2 Total | 57,434 | 631 |

| First Half 2013 | 85,609 | 473 |

Stephen Gutteridge, Chairman of Nighthawk, commented:

“The rapid growth in production as a result of the highly successful spring drilling campaign has transformed Nighthawk. At current prices and production levels, monthly net revenues are at a run rate in excess of US$3 million. With a payback on drilling at Arikaree Creek of less than three months and multiple new drilling locations on the field, we look forward to being able to boost production and revenue further with our planned Q4 2013 drilling campaign.”

New Southern Cheyenne Well Shows 2,000 bopd

New Southern Cheyenne Well Shows 2,000 bopd

Chama Oil and Minerals, LLC, has made public it’s results at their new Pronghorn well located southeast of Kit Carson, in southern Cheyenne County. The production at the Pronghorn well topped 2,000 bopd, significantly higher than even the initial 1,700 bopd results from the Jake well that was the lynch pin to start the Niobrara play in 2009. Details are published in the Rocky Mountain Oil Journal (May 6, 2013) and the Denver Business Journal. Early analysis of the emerging play in southeastern Colorado has focused the attention and activity of industry players on Cheyenne, Lincoln, Kiowa, Bent and Prowers Counties.

New Drilling Report (from StockMarketWire.com)

New Drilling Report (from StockMarketWire.com)

Nighthawk new drilling programme under way

19 April 2013

StockMarketWire.com – Nighthawk Energy has begun a two well drilling programme at Smoky Hill with the Big Sky 4-11 well spudded on 17 April.

It says the Taos 1-10 well, also at Smoky Hill, will be drilled immediately after Big Sky 4-11.

Both are planned as development wells to increase production and reserves at the newly-named Arikaree Creek oil field, discovered by Nighthawk’s Steamboat Hansen 8-10 well in October.

Nighthawk says further geoscience analysis of 2012 drilling and logging results have confirmed the stacked pay potential across its acreage with at least 10 stratigraphic targets covering both shale/carbonate resource and conventional opportunities.

And it says increased third party drilling activity across south-east Colorado continues to demonstrate the widespread nature of the stacked pay opportunity.

Chairman Stephen Gutteridge said: “Our current two well drilling program is aimed at increasing our production and reserve base and pushing our existing positive cash generation to a higher level.

“Beyond that however, the emerging picture is that we are centrally positioned in a large-scale, stacked formation play that is now undergoing a significant amount of drilling and development by a wide range of companies.

“On our acreage, which is one of the largest land positions in the area, we see a major opportunity for multiple drilling of multiple stratigraphic targets and we will be planning for extensive additional development activity in the second half of the year.”

Colorado Oil Production Summary for March 2013

Colorado Oil Production Summary for March 2013

Oil exploration and development in Colorado is expanding swiftly beyond the Denver-Julesberg basin. The industry spotlight is now swinging toward Southeast Colorado. There, new wells are targeting Mississippian and Pennsylvanian tight oil previously not explored using conventional techniques, but now profitable through horizontal drilling technology. In some cases, horizontal drilling has re-opened interest in areas previously thought to be fully explored.

The success of the Nighthawk horizontal well projects in 2012 is now followed by Nighthawk’s assessment of production potential in their Steamboat Hanson 8-10 site. The Steamboat Hanson 8-10 well produced 22,000 barrels of oil from November 2012 to February 2013. An independent evaluation of Nighthawk’s Smoky Hill project Steamboat Hanson 8-10 well estimates a reserve potential of 14.5 million barrels of oil. Steven Gutteridge, Chairman of Nighthawk Energy, announced that having secured $5 million in addition funding, his company plans more exploration in Southeast Colorado in 2013.

Crude oil production has risen 64 percent in Colorado from 2007 through 2011. Oil reserves in the state may prove to be around 2 billion barrels.

Sources: UPI, Morningstar

Colorado’s Niobrara Oil Play Not the Only Game in Town

Colorado’s Niobrara Oil Play Not the Only Game in Town

Read more about southeast Colorado oil development at the Denver Business Journal:

Crossroads of Tight Oil Plays

Southeast Colorado is the crossroads of multiple North American tight oil plays. This is a region where geology has identified multiple deep oil plays. Exploration in 2012 has begun to demonstrate that extraction technology can be tuned to generate significantly productive commercial yields from the underlying strata.

Southeast Colorado is the crossroads of multiple North American tight oil plays. This is a region where geology has identified multiple deep oil plays. Exploration in 2012 has begun to demonstrate that extraction technology can be tuned to generate significantly productive commercial yields from the underlying strata.

Our base in the core counties of Cheyenne, Kiowa, Bent have been a quiet resource play for three generations. Vertical drilling of the underlying Las Animas Arch has been a consistent profit engine for speculative exploration, development and resource companies.

Tight oil and gas prospects have been explored and developed in Ohio, in the Bakken, Eagle Ford and the Denver Basin. Carbonate-bearing shale and lime layers to the north, south and east in these profitable plays also extend through the Las Animas Arch region of SE Colorado. Here, there is the real possibility of targeting multiple pay zones at several depths, either concurrently or sequentially. At the same time, new conventional reservoirs are still being identified in vertical drilling.

Mississippi Lime Production Expected to Quadruple

Mississippi Lime Production Expected to Quadruple

Analysts expect production to increase over four-fold from the current level of 3.5 million barrels per day to 15-18 million barrels per day by 2020. Extracting Oil trapped in Mississippi Lime strata has proven easier and cheaper than shale oil. Mississippi Lime extends from Kansas through the Las Animas Arch of southeastern Colorado.

The IHS Unconventional Energy Blog points to the Southeast Colorado as an emerging new play in unconventional energy development.

The IHS Unconventional Energy Blog points to the Southeast Colorado as an emerging new play in unconventional energy development.

Check out this article, which clearly identifies “A Paleozoic play along the Las Animas Arch in Colorado and oil targeted drilling in the Pearsall shale in the western part of the Eagle Ford fairway also highlight new play activity”.

You can click here to See the article at the IHS Unconvention Energy Blog Site.

Oil Exports Trim U.S. Trade Deficit as Fuel Gap Shrinks: Economy

The following article is from Bloomberg News. To read the entire article, use the link below.

Oil Exports Trim U.S. Trade Deficit as Fuel Gap Shrinks: Economy

By Shobhana Chandra – Feb 8, 2013

In this very excellent article, Bloomberg/Business Week reports:

“Record petroleum exports helped shrink the U.S. trade deficit in December to the smallest in almost three years as America moved closer to energy self- sufficiency, a goal the nation has been pursuing since the 1973 Arab oil embargo.

“The gap narrowed 20.7 percent to $38.5 billion, the smallest since January 2010 and lower than any estimate in a Bloomberg survey of 73 economists, Commerce Department figures showed today in Washington. Oil exports climbed $11.6 billion. Another report showed wholesale inventories unexpectedly declined in December.

“In addition to trimming the trade deficit, greater fuel autonomy helps boost household incomes, jobs and government revenue and makes American companies more competitive. An improving global economy, reflected by record exports to South and Central America, also means manufacturers such as Caterpillar Inc. will benefit.

” ‘The trend toward energy independence is there, and it is picking up,” said Andy Lipow, president of Lipow Oil Associates LLC in Houston with more than 30 years of experience in refining and trading. “This bodes well for our economy. As our oil production increases, our reliance on other parts of the world for oil comes down.’ ”

“Stocks climbed, sending the Standard & Poor’s 500 Index to the highest level since November 2007, after the report and on corporate earnings that topped estimates. The S&P 500 rose 0.6 percent to 1,517.93 at the close in New York. Shares of oil and gas companies such as Hess Corp. and Valero Energy Corp. also advanced . . .”

To read the full article and follow the embeded links, go to

US Pumps Up Oil Output, Big Gains Seen for 2013

The following news article is from CNBC (to read the full article, use the link, below)

US Pumps Up Oil Output, Big Gains Seen for 2013

Published: Tuesday, 8 Jan 2013 | 7:45 PM ET

By: Patti Domm

CNBC Executive News Editor

The growing role of the U.S. as a major energy producer is changing the dynamic of the energy market.

U.S. oil production continues to accelerate at a surprising rate, and the government now predicts the U.S. industry could pump 14 percent more oil this year alone. The use of non conventional drilling techniques in places like North Dakota and Texas has created an explosion in U.S. production to the point where the U.S. is expected to surpass Saudi Arabia in crude production by 2020, according to U.S. government statistics.

At the same time, the industry is developing more pipeline capacity to carry landlocked U.S. crude from storage in Cushing, Okla. to the Gulf Coast refining areas. That should continue to drive the trend, create more refined product for the U.S. and export markets, and bring down some oil prices in the next several years, according to the Energy Information Administration.

In the next few days, a significant pipeline expansion is coming on line as the Seaway pipeline adds 250,000 barrels a day in capacity from Cushing to its current 150,000 barrels. In anticipation, the market has compressed the spread between U.S.-produced West Texas Intermediate and the international bench mark Brent crude, to below $18, the narrowest level since September.

To read the full article, go to http://www.cnbc.com/id/100364226

SandRidge Energy, Inc. to Sell Permian Assets to Focus the Lucrative and Oil-rich Mississippian Play.

SandRidge Energy, Inc. to Sell Permian Assets to Focus the Lucrative and Oil-rich Mississippian Play.

December 19, 2012

SandRidge Energy has announced that the corporation will sell their Permian Basin assets for $2.6 Billion In Cash. The sale is part of SandRidge Energy’s plan to make a strategic shift from natural gas to emphasis oil and petroleum development. The sale to Sheridan Production Partners II will be effective January 1, 2013, and close in the first quarter of 2013.

SandRidge President and CEO Tom Ward said, “With these proceeds we will have a cash balance of almost $3 billion and liquidity of over $3.5 billion, which we intend to use to reduce debt and strengthen the balance sheet. This will also allow us to fund development of our acreage position as well as future opportunities in the highly scalable, high return Mississippian Play.”

Ward added, “We are excited about focusing our efforts on the Mississippian, which encompasses parts of northern Oklahoma and western Kansas, an area we believe generates some of the highest rates of return for horizontal drilling in the U.S. today. With 1.85 million net acres and 11,000 possible future drilling locations, the Company is the industry leader in the region.

Hard numbers tell why the petroleum industry is investing heavily in Colorado and the other Plains States

Hard numbers tell why the petroleum industry is investing heavily in Colorado and the other Plains States

Report says we have more oil than we thought

By TOM FOWLER, HOUSTON CHRONICLE | September 15, 2011

Gauging the optimism of the Mississippian Lime oil and gas play

Gauging the optimism of the Mississippian Lime oil and gas play

Wichita Business Journal by Daniel McCoy, Reporter

Date: Wednesday, November 28, 2012, 2:36pm CST – Last Modified: Friday, November 30, 2012, 10:55am CST

http://www.bizjournals.com/wichita/blog/2012/11/gauging-the-optimism-of-the.html?page=2

Nighthawk Energy strikes oil at Jolly Ranch

Nighthawk Energy strikes oil at Jolly Ranch

UK junior Nighthawk Energy has made a conventional oil discovery with its latest probe at the Jolly Ranch play in Colorado’s Denver-Julesburg basin.

http://www.upstreamonline.com/live/article1300048.ece

3 December 2012

NIGHTHAWK ENERGY PLC

Drilling Update

New Mississippian oil discovery at Steamboat Hansen 8-10 well

Nighthawk, the US focused shale oil development and production company (AIM: HAWK and OTCQX: NHEGY), announces an update on its drilling program including a new oil discovery at the Steamboat Hansen 8-10 well at its 100% controlled and operated project at Jolly Ranch in the Denver-Julesburg Basin, Colorado.

Highlights

· The Steamboat Hansen 8-10 well, the fourth well in Nighthawk’s 2012 drilling program, has discovered a Mississippian age, conventional oil-bearing reservoir at a depth of just over 8,000 feet

· The reservoir has been logged and tested and the well has been brought onto production

· Internal analysis indicates potential oil initially in place of 4 to 8 million barrels

· Planning for further development of the reservoir is underway

· Open-hole logging of the Steamboat Hansen 8-10 has identified oil producing potential in the Cherokee shale formation at a depth of around 7,400 feet

· Well confirms significant potential in Nighthawk’s hitherto undrilled northern acreage and this area now to be separately identified as the Smoky Hill Project*

· Whistler 6-22, the final well in the drilling program and also located in the Smoky Hill project area, currently being tested in the Cherokee and Marmaton formations

Steamboat Hansen 8-10 Well

(Nighthawk 100% Working Interest/80% Net Revenue Interest)

The Steamboat Hansen 8-10 well is the fourth well in Nighthawk’s 2012 five well drilling program. The well was successfully drilled to its target depth of 8,500 feet in seven days. The well was logged and cased.

This is the most northerly well drilled on Nighthawk acreage, over 20 miles north of the recently drilled John Craig 6-2 well, and 45 miles north of the older Craig wells. It is the first well drilled in this area for over 25 years. The well had two primary objectives, to establish the commercial potential of the Cherokee shale formations in this northern area and to test a specific Mississippian structure identified from 3D seismic analysis.

Both objectives have been successfully achieved with the open-hole logs identifying oil producing potential in the Cherokee shale formation. However, further testing and completion of this zone will not be undertaken until the newly discovered deeper oil reservoir is produced.

This structure is Mississippian in age and the well penetrated two oil-bearing intervals totaling thirty-eight feet between 8,025 and 8,065 feet deep. These intervals were logged and a bottom hole pressure build-up was performed. Both oil-bearing intervals were tested and the results showed a 75:25 oil/water ratio. The well was completed naturally without acid stimulation or clean-up.

Initial analysis of the oil shows it to be a light 38-40 degree API, slightly viscous oil. Appropriate production facilities, including heated storage tanks, have been installed and commercial production commenced on 28 November 2012. An update on production rates will be issued once steady production has been established.

Nighthawk’s analysis of the reservoir indicates potential for oil initially in place of 4 to 8 million barrels depending on assumptions around the areal extent of the structure. The Company is commissioning an independent assessment of the reservoir potential which will provide greater detail on the oil in place and the potential recovery factors.

Further development work is likely to be required to fully evaluate this discovery.